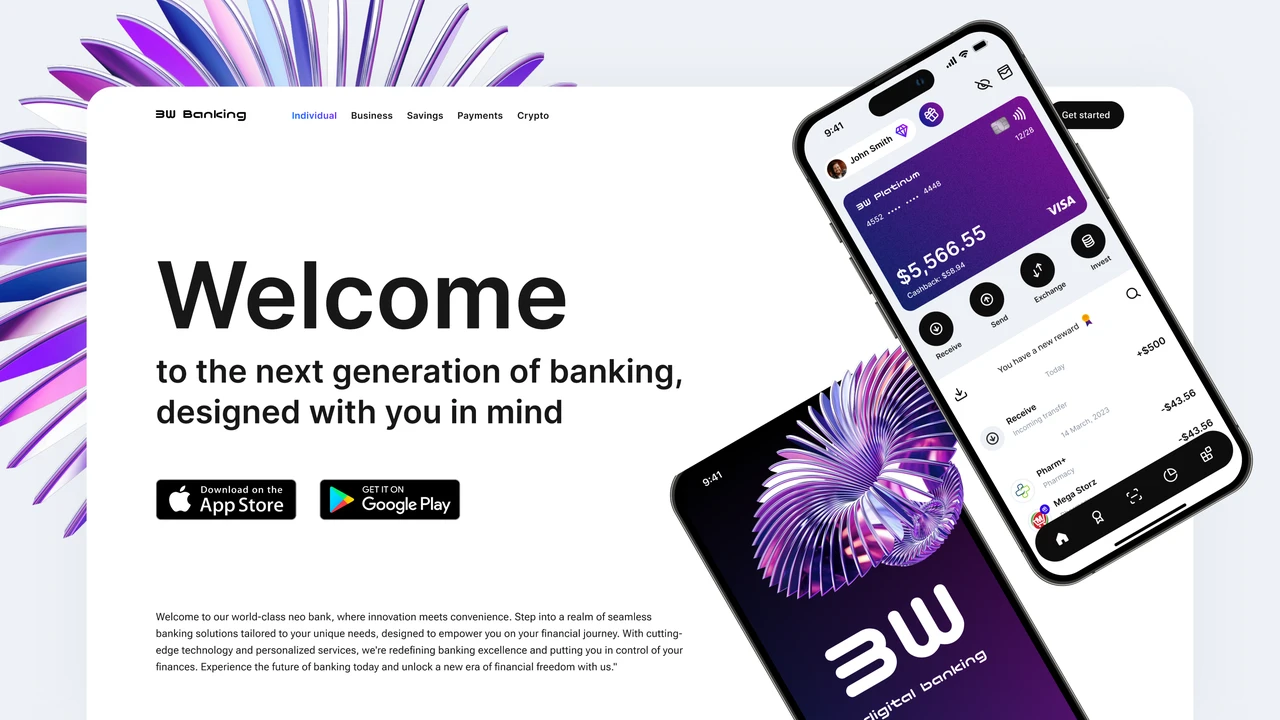

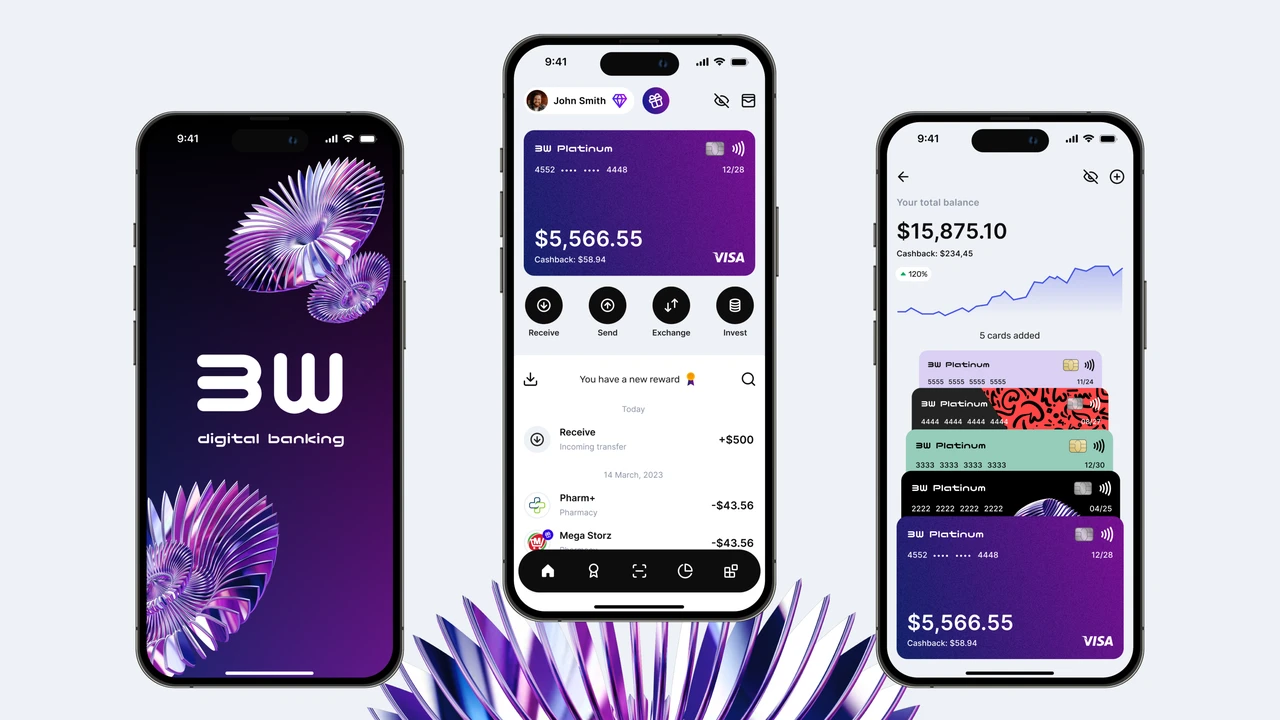

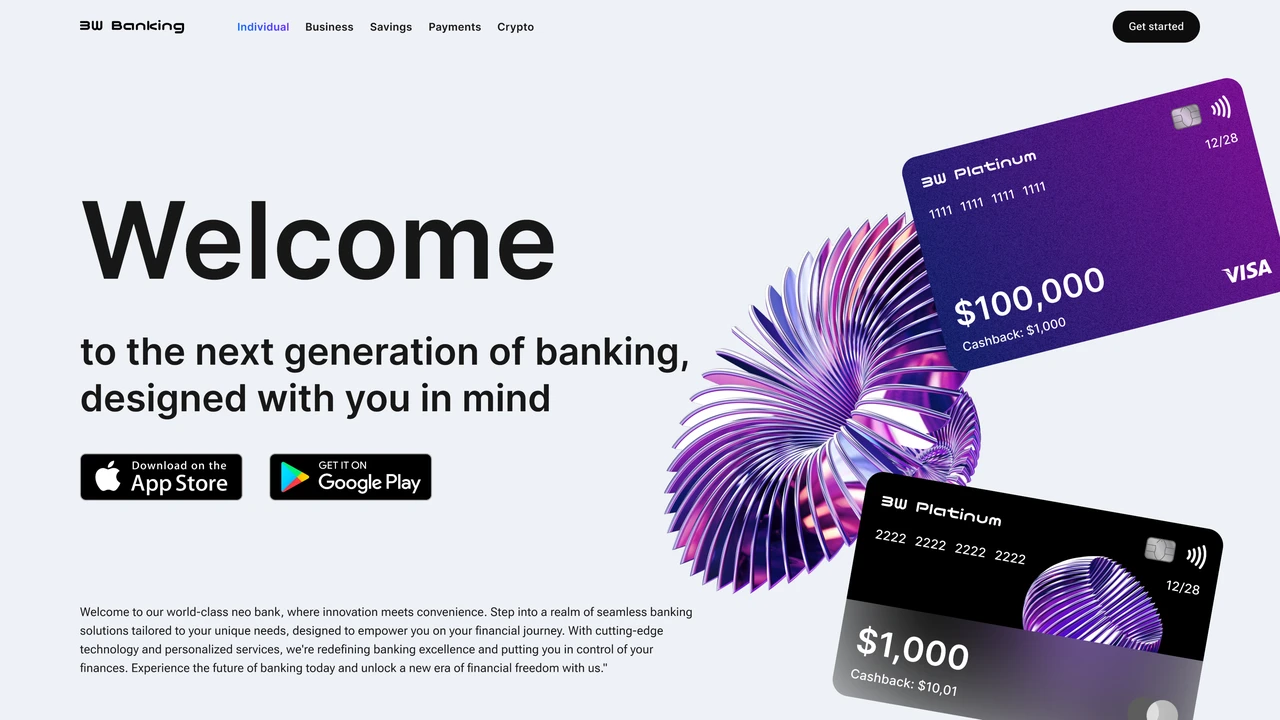

NDA, Neobank Company

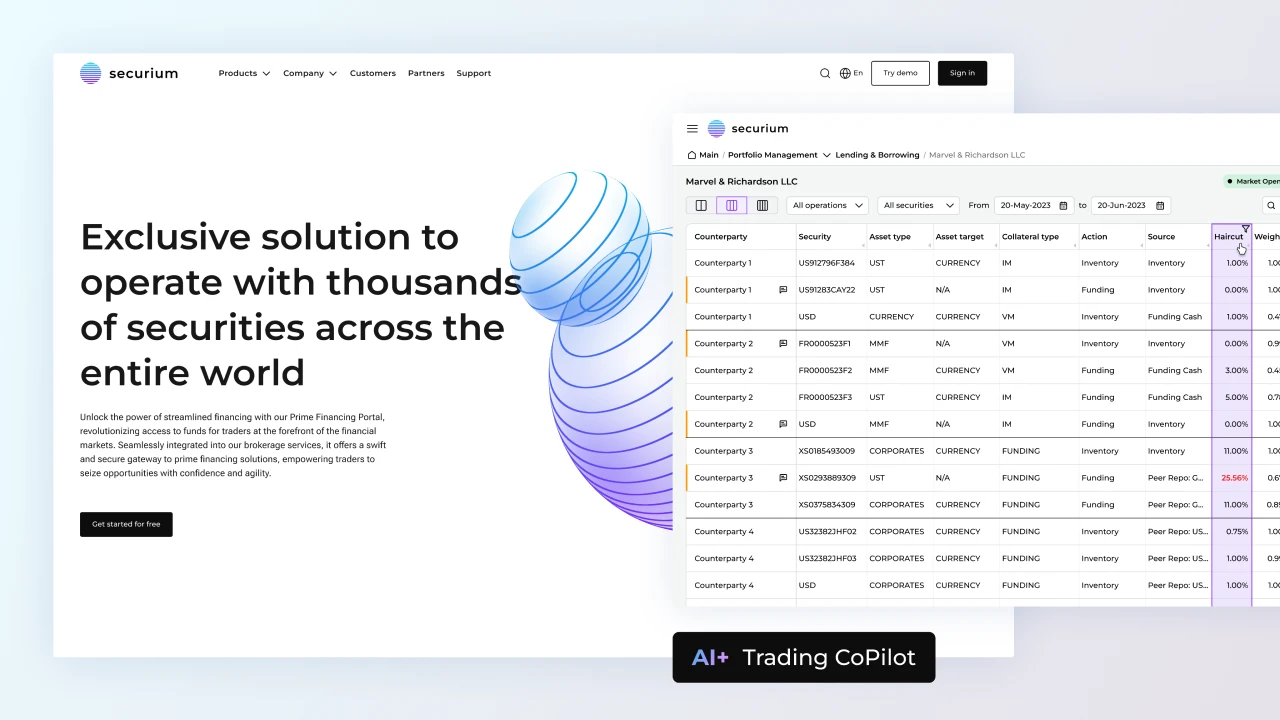

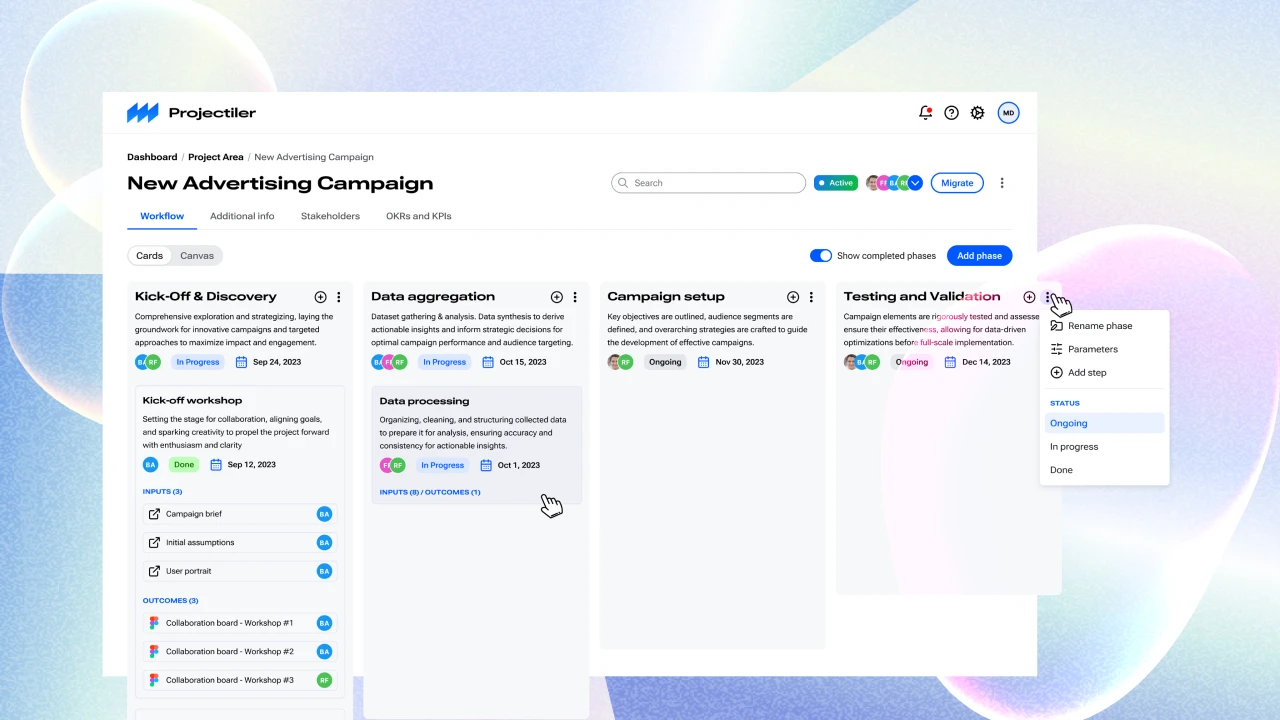

Fintech, Banking

Java, Spring Boot, TypeScript, NextJS, React, React Native, Azure Infrastructure

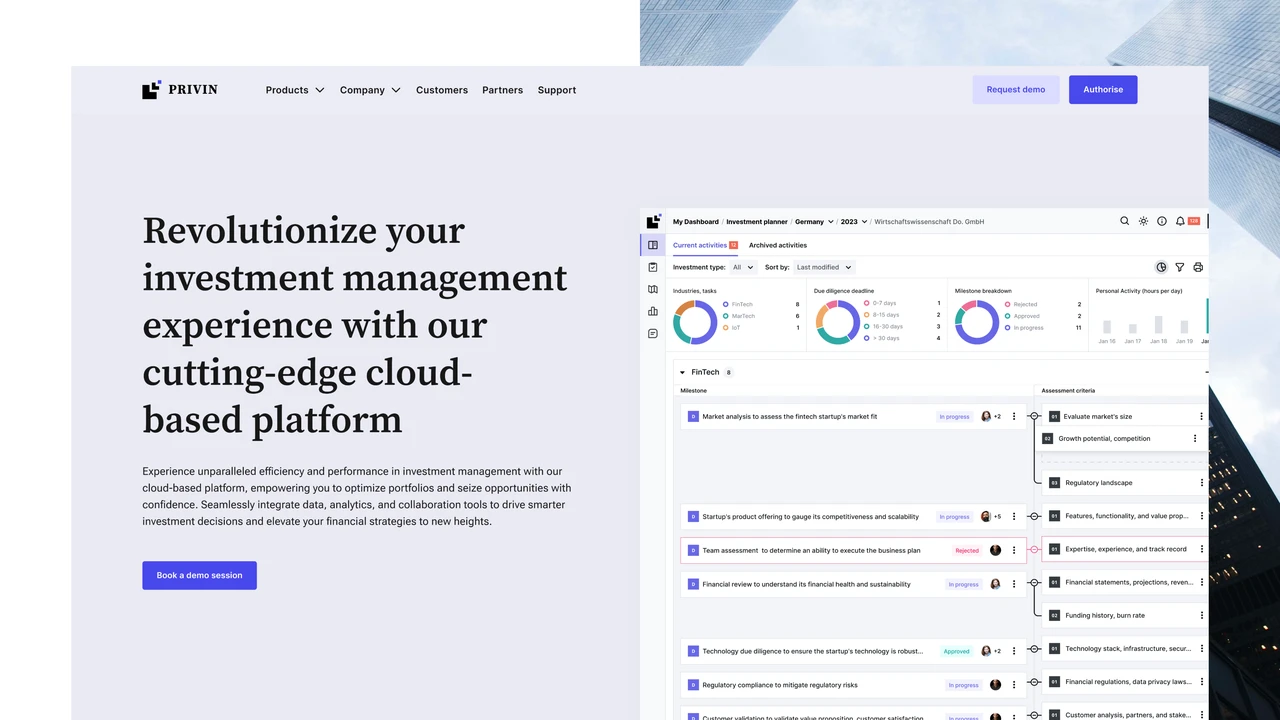

Enhance your browsing experience by a selection of related projects and success stories. Each case study showcases our expertise in delivering innovative solutions across various industries, offering insights into our approach to solving complex challenges and achieving significant outcomes. Whether you’re seeking inspiration or looking for a specific solution, these handpicked case studies are intended to provide you with valuable perspectives and ideas that align with your interests and needs.

Let’s get to know your requirements first. Tell us about your project, and we will get back to you and arrange a free consultation call to discuss how we can help.